Shaw Solar keeps a pulse on rebates and incentives, clearly outlining them in your custom proposal and guiding you through every step—so you don’t leave a single dollar on the table.

Federal Incentives:

The Federal Tax Credit for Residential solar ended in 2025, but tax credits for Commercial solar lives on at the full 30% with bonus credits available that bring the savings up to 50%. Amazing!

But wait, there’s more…..Commercial solar also comes with BONUS depreciation benefits - think an additional 25-30% savings.

Long story short - if you own a business now is the time to explore solar!

State Incentives in Colorado:

Colorado has generous tax credits and rebates in place - way to go Colorado!

Batteries aka Energy Storage:

A credit on your State taxes equal to 10% of material costs for battery installs. This comes out to ~$1,000 per battery. Heck ya.

Mini Split Heat Pumps:

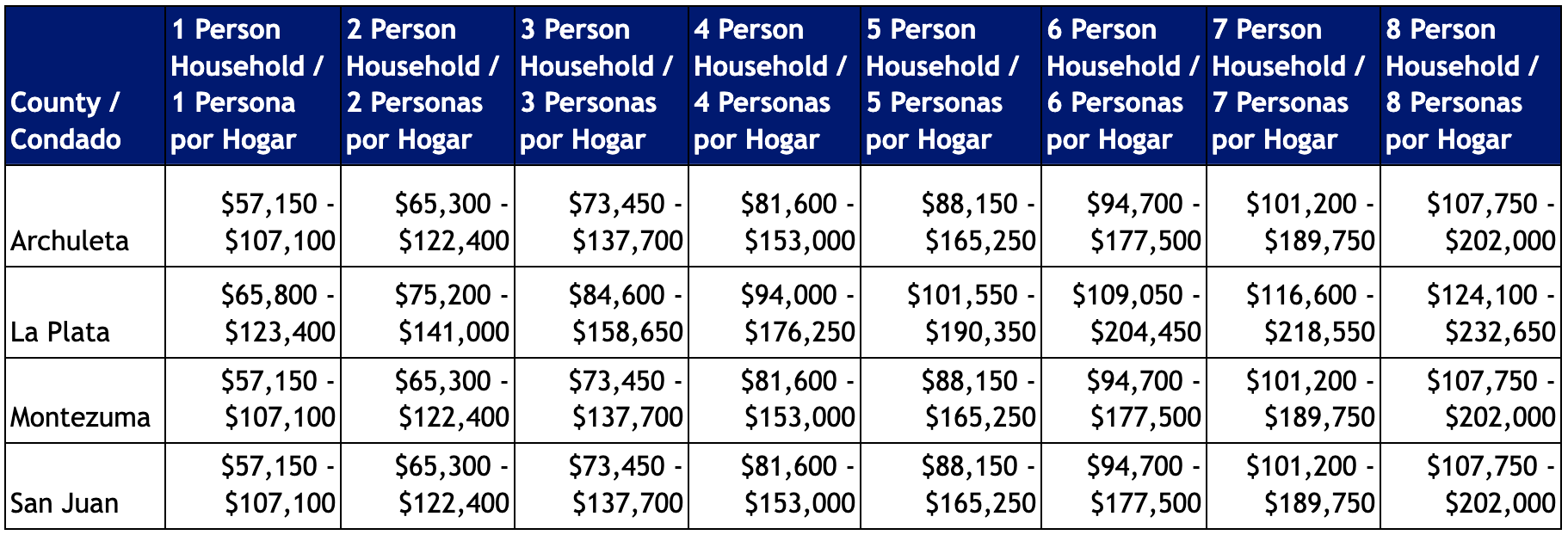

There are major rebates for Heat Pump installs thanks to the new state program called HEAR (Home Electrification and Appliance Rebates). These are income-qualified rebates, but households earning up to 150% of AMI qualify!

Shaw Solar is proud to be a registered contractor eligible to do these installations.

Rebates up to:

$8,000 for cold-weather heat pump installs (standard in our area)

$4,000 for electric panel upgrades

$2,500 for electrical wiring!

More info on the HEAR program can be found here, but we’ve summarized the income info below for ease:

Get Your Custom Proposal Today

No hassle, no commitment. Just all the helpful info on rebates and incentives.